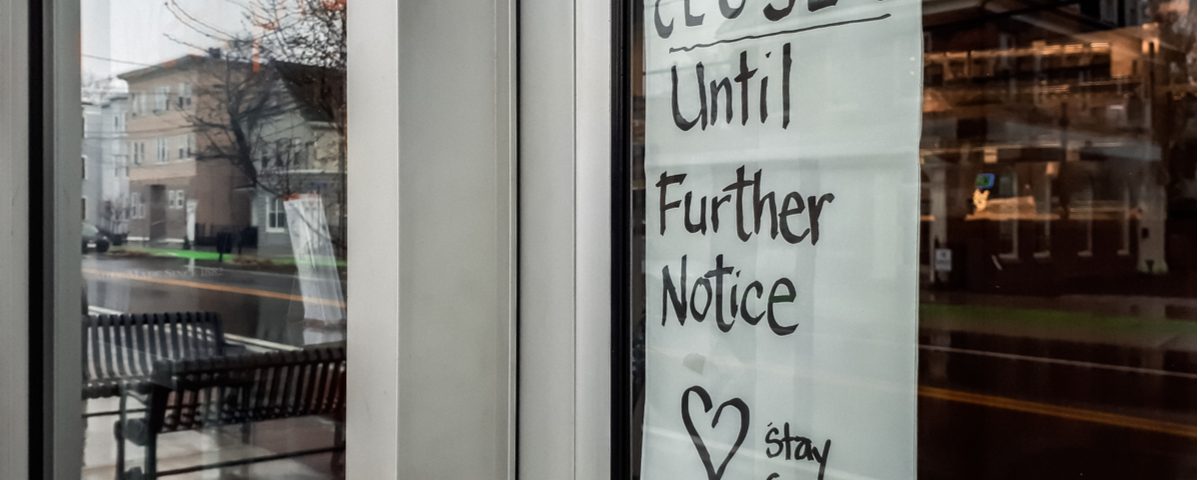

Helpful Financial Tips for Small Businesses as They Operate Through the COVID Crisis

If you own a small business, helping your company grow is one of the most important things you can do to develop the proper money management skills. You must manage your business with the right financial skills as early on as you can.

It doesn’t matter if you have always considered yourself financially savvy or if you have experience with acquiring a personal loan with fair credit, you will benefit from the financial management tips found here.

Keep Track of Your Deadlines

Just as you remain conscious of your personal loan payments or credit card bills, you must remain diligent in paying the bills related to your business on time. From utility bills to tax payments, it is smart to setup payment reminders, so you won’t miss anything.

If you leave these things unchecked, the late penalties may snowball easily and result in your business going into debt. With a small business that has a limited working budget, every penny counts. However, if you stay on top of your bills, it can help you save hundreds or even thousands of dollars that you can invest in things that will help your business grow.

Separate Your Personal and Business Finances

Some small businesses are guilty of meshing personal finances with business finances. While you may have the very best intentions when it comes to using your personal money to fund your business, it may complicate matters down the road.

Even if it isn’t required that you separate your personal and business finances, having separate bank accounts and books will help you better monitor your cash flow.

Monitor Your Books Diligently

Even though you are working with an accountant and bookkeeper, you still need to keep track of your expenses, along with your account’s receivables, and monitor your books regularly. By conducting regular checks, you can get a handle on your finances and spot potential discrepancies in the numbers.

Make Smart Budget Choices for Your Business

You have to be dedicated to making smarter budget choices for your business. This means creating and sticking to a budget, timing your expenses, being frugal when possible, and keep a cash reserve ready to use when needed.

Pay Yourself

It isn’t uncommon for small business owners to focus all their finances on funding their options, which means they fail to pay themselves. However, experts don’t agree with this practice. When you own a business, you need to pay yourself for the work you do. This is imperative and something you cannot afford to ignore.

When it comes to working through times of crisis, such as the coronavirus pandemic that is going on now, it is imperative that you take steps to protect your finances. The steps here will help you get through this difficult time and set your business up for growth and success both now and down the road as things begin to get back to normal.