Navigating an IRS Audit

Navigating an IRS Audit

In the month of April there are usually two things on Americans minds, 1) Easter and 2) April 15: TAX DAY! And the IRS is waiting with their hand out (as well as state tax agencies.) Depending on which side of the coin you are on, tax season can be full of anxiety and angst or bring a sigh of relief when the amount of the return is announced. Being able to navigate known waters will always serve the taxpayer well, but often times is a difficult skill to acquire. I have heard it said knowledge is power so my hope with this article is to give you more knowledge about the IRS and the so called “power” the service holds.

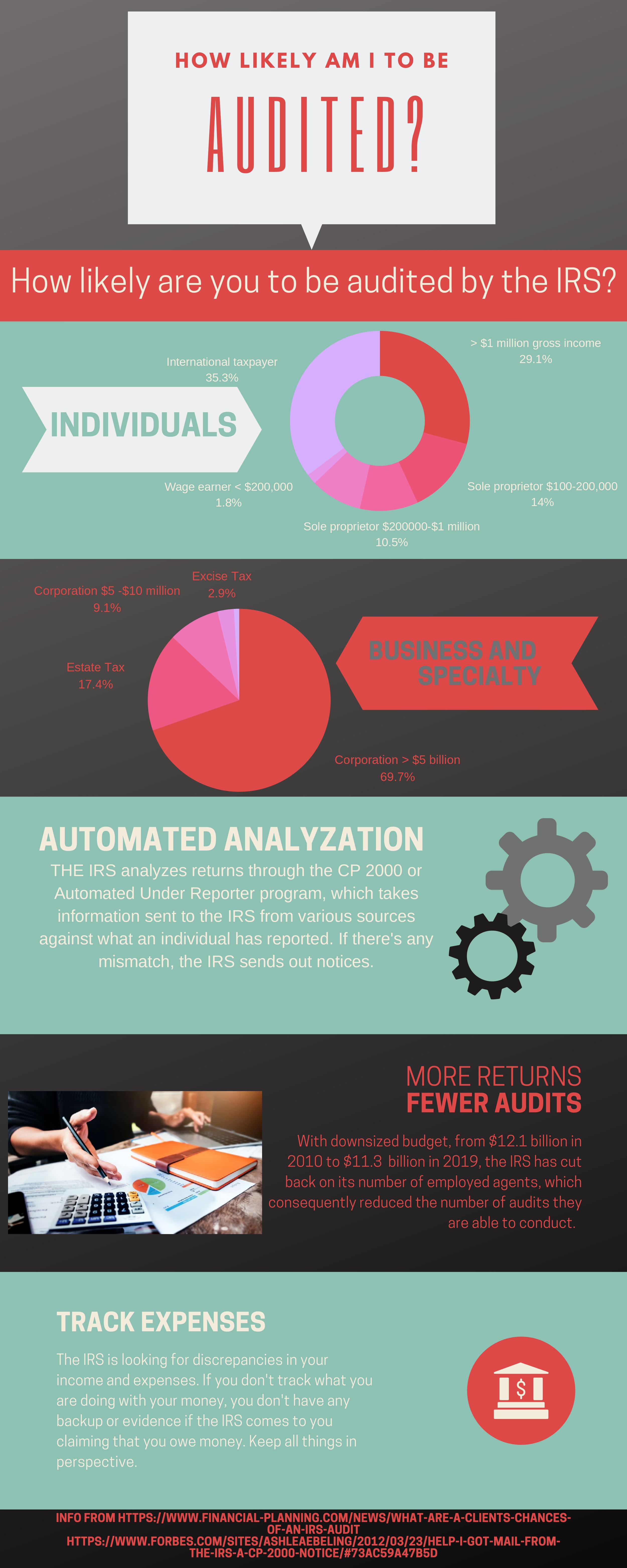

There was a recent article in the accounting magazine, Accounting Today by Jim Buttonow, “only one out of 184 tax payers were audited in 2017 and less than a quarter of those were conducted in person.” Jim goes on to say that most IRS audits these days are done by mail. So many things go into an audit. But there are a few things that can be done on the taxpayers part to create a smoother sailing through the process should you ever find yourself in the crosswinds.

Ignorance is certainly not bliss in the IRS audit world. If you get a letter from the IRS, certainly don’t ignore it. It won’t make them go away. It will do the opposite. I can create opportunities for the Service to assess additional tax on the areas in which they are requesting an audit. So to face the music head on is the best tactic.

Some of the other advice given in the article by Buttonow is to never ignore deadlines and the one that is imperative, DO NOT under any circumstances lie to an IRS agent. It is a FEDERAL CRIME to lie to a federal agent. If pride keeps you from telling the truth, this is not the time to rest on your laurels. Know that there have been bigger fish that have gone before you, so find the courage to tell the truth!

Other bits of advice: don’t be afraid to ask for written requests from your agent. And if there is anything in question, it is perfect protocol to request a meeting of your agent’s manager. Wit these things being said, it is only reasonable that you come to your audit fully prepared with all documentation that is asked of you.

All of these tips and tricks should help demystify the IRS audit process. It is all a routine type thing once the timeline starts. Don’t let the dark cloud of the big storm intimidate you. With proper planning and a road map staying the course as a taxpayer, and IRS audit doesn’t mean you have done anything wrong. Unless you have; then worry starts. Due diligence is key as a taxpayer. You owe it to yourself to know what you can do to navigate the waters during an audit so you can have smooth sailing!